CFO vs. Controller: The Missing Piece in Your Growth Strategy

Written by: Scott T Rauth, CFO

When your company is just getting started, a controller and an input person or two will probably get the job done. But as you really start to take off, it’s time to bring in a Fractional CFO.

When your company is just getting started, a controller and an input person or two will probably get the job done. But as you really start to take off, it’s time to bring in a Fractional CFO.

Why? The experience and insights a CFO brings to the table can make a big difference in how you grow. A CFO will always be looking forward in your business to make sure you have the right strategies in place to meet your goals.

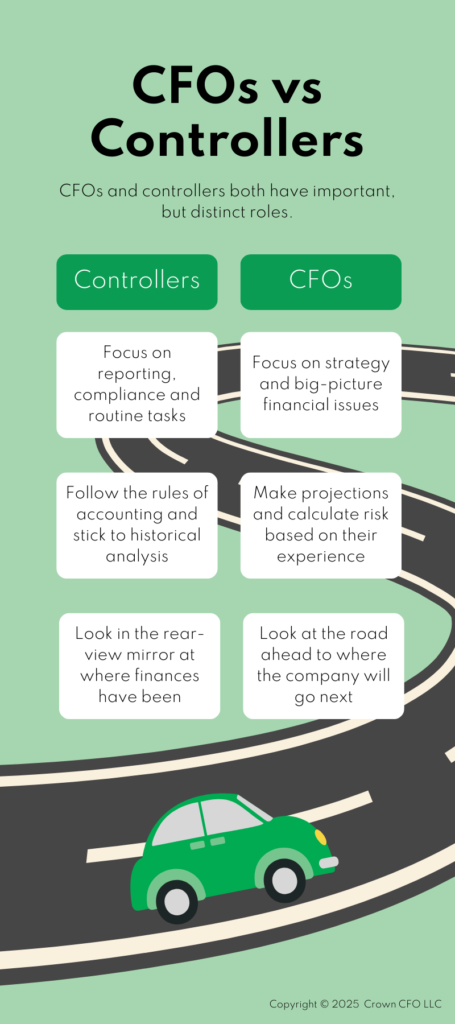

What’s the difference between a controller and a CFO?

Generally, a controller focuses on month-end financial reporting, compliance, taxes, payroll and overseeing accounts payable and accounts receivable.

A CFO will be more focused on financial visibility, cash flow planning and management, and tax strategy. They’ll work closely with you as the CEO on your overall strategic plan — where your business is headed and the resources you’ll need to get there.

The strategic role of a CFO

A CFO has three major responsibilities:

- Increase revenue by reviewing and updating your pricing methods regularly and as circumstances change.

- Decrease costs by shopping around some of your biggest expenses and reducing your spend.

- Mitigate risks by reviewing your customer concentration and your insurance coverage.

Unlike controllers, a CFO can take on these responsibilities because they’ve been down these roads before and know where to look for opportunities to tackle each one. For instance, busy CEOs who feel loyal to companies they worked with as they started out often overlook periodic vendor reviews. But that’s leaving money on the table, and most controllers don’t know when to push for change.

One client I worked with was spending $600K annually on health insurance, but I knew we could find an option that retained solid benefits for their employees at a lower cost. After looking around, we moved them to a self-insured health plan — an option the client hadn’t known about — and reduced their annual spend by $145K.

A CFO is in the position to address issues like these and work with insurance companies, banks, and your investors to deal with high-level, strategic challenges. While controllers are typically quite knowledgeable about the routine financial issues of a company, most aren’t equipped to lead your company in these discussions like an experienced CFO.

Do you need both a controller and a CFO?

In short, yes. In fact, adding a CFO to your team can be a big relief to your controller. A controller for a company with more than $5M in revenue is likely hitting the limits of their experience and being asked to do more than they’re prepared for.

We’ve seen companies that are months behind in their accounting because the controller has been pulled into large projects and meetings that aren’t their area of expertise. They simply don’t have enough time to do their work because they’ve been asked to do things outside their scope.

How a Fractional CFO can help

While a full-time CFO can take some of these tasks off your controller’s plate, they also come with a full-time salary. A Fractional CFO offers deep, diverse financial expertise and experience without the hefty cost.

A Fractional CFO can relieve your controller of complex duties they aren’t ready for and let them get back to the important work they should be focused on instead. A Fractional CFO can also help your controller by:

- Being the interface between them and the CEO and board, turning leadership’s vision into the practical day-to-day advice and direction they need.

- Acting as a sounding board for their ideas (as someone who’s just as passionate about the numbers as they are) and advocating for them with the organization’s leadership.

- Introducing them to new technologies and methods that make processes like month-end and bank reconciliation more efficient.

- Helping work through complex issues and problems they haven’t dealt with before.

The right Fractional CFO can even prepare your controller to become your CFO in the future. Sometimes a controller has the background to become a CFO if they’re mentored by someone who’s been there for a number of years. In that case, a Fractional CFO can help prepare them over time and be there as an advisor after they assume the role.

Get the forward-thinking financial leadership you need from a Fractional CFO

Your controller and a Fractional CFO will both play an important role in your success. They make a powerful team, working together to keep your finances running smoothly while strategically steering your company in the right direction for the future.

If you’re in Kansas City, one of the experienced financial leaders at Crown CFO can complement your existing finance team and be the advisor they need. Contact Kerry George at kerry@crowncfo.com to bring a trusted, expert Fractional CFO to your business.